Background

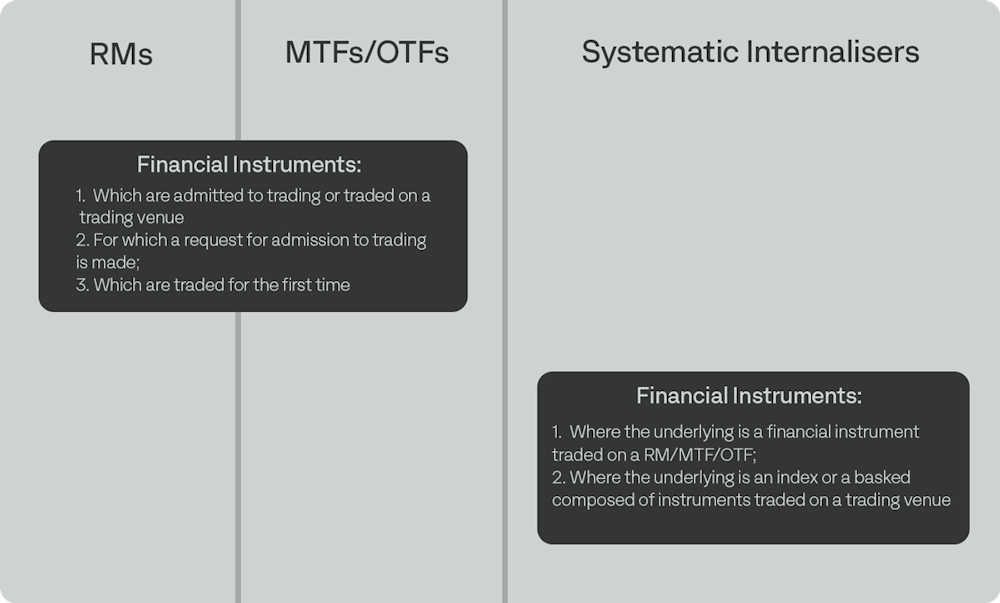

Reportable financial instruments are defined as follows (irrespective of place of execution):

a) instruments admitted to trading or traded on a trading venue or for which a request for admission to trading has been made;

b) instruments with underlying traded on a trading venue; and

c) instruments with underlying being index or basket composed of instruments traded on a trading venue

Systematic Internalisers (SIs), as per Article 27, are required to obtain ISINs and submit to FIRDs only for instruments reportable under Article 26 and which aren't already submitted by a trading venue.

FIRDS: Figure 1: Scope of Instrument Reference Data

SIs themselves are outside of the MiFIR ‘trading venue’ definition as per Article 4(1)(24) of MiFID.

Problem

Unfortunately, some SIs are submitting their ISINs to FIRDS for products which are not reportable under Article 26.

FCA stated “firms and trading venues should have mechanisms to avoid reporting (…) where the instrument does not fall within scope of Article 26(2) of UK MiFIR.“ (FCA: Reportable Instruments; Over-reporting)

Solution

Control Now interpretation of reportability has been changed to no longer treat instruments exclusively traded through SI as automatically reportable (i.e. if the only FIRDS listing is related to SI). We are now checking the underlying and determining reportability of those instruments based on Article 26 (b) or (c). Clients will see this on their report as validation M106.

Using the ISIN generated and submitted to FIRDS by SI in field 41 (Instrument Identification Code) is allowed and expected, however the reportability of such instrument is determined by the underlying.

Future changes

ESMA has included a proposal to extend the scope of reportable instruments in the Consultation Paper on MiFIR review report on the obligations to report transactions and reference data. The proposal suggested to include instruments listed exclusively on SIs where underlying doesn't meet criteria defined in Article 26 (b) or (c) to include also all derivatives in the same sub asset class for which the firm is an SI. The proposal was met with general acceptance and was retained by ESMA for future implementation in the Final Report to Consultation Paper (see 79).